Research #1 - Lodestar Finance

How to maximize returns and unlock liquidity of your favorite Arbitrum yield bearing assets? Lodestar Finance may have the solution.

Disclaimer: I'm not part of the Lodestar Finance team nor I have financial or whatsoever compensation for this article.

These are my own thoughts. As always this is NFA and DYOR before investing.

We'll research Lodestar Finance through a standard framework:

Protocol Intro

Market fit

Team

Tokenomics

Value Accrual

Addressable market

Competition

Roadmap

Strategies

Security

Conclusion

Protocol Intro:

Lodestar Finance is a money market unlocking liquidity of yield bearing assets on Arbitrum.

It’s a compound fork, allowing you to lend/borrow liquid staking/yield bearing assets.

Blue chips (BTC, ETH) will be supported as long as USDC, MAGIC, DPX, USDT, FRAX, MIM and plvGLP at launch.

Lodestar has modified Compound interest rate “Jump Rate” model for a more competitive money market approach. There are 5 interest rate model, each one of them tailored made for the different asset class. For blue chips, there is a higher collateral ratio for better capital efficiency. For riskier assets, borrow curve for utilisation ratio >80% is more exponential to rapidly offset risk for the platform in that zone and incentivise borrowers to repay their loan.

Market fit:

There is a lack of money market for yield bearing assets on Arbitrum. We have great #realyield assets but no place to unlock the liquidity opportunities of the underlying assets.

Instead of just staking your yield bearing assets like GLP, GMX for instance, you'll be able to borrow assets against them and still keep the realyield coming in.

This is opening opportunities for leveraged long/short on these assets as hedging or self repaying loan.

Lodestar will apply a 10% performance fee to grow the asset reserve and reward $LODE stakers. We'll touch upon that later.

Team:

Lodestar team is composed of four Anons with a crypto and/or engineering background. This is their first project in the space. Follow them on Twitter and listen to the first AMA to get a good grasp of of the team’s vibe:

Quanta (@MagicQuanta)

Coopes (@Coopesmtg)

Appo (@0xAppo)

Waffle (@TheWaffleApe)

AMA link:

Anon team could be scary but no red flag so far, the team is smart and have a clear vision of where they are headed.

They handled with care the fundraise plan so far, putting the community at the center of their decision and responsive on the Discord.

Tokenomics:

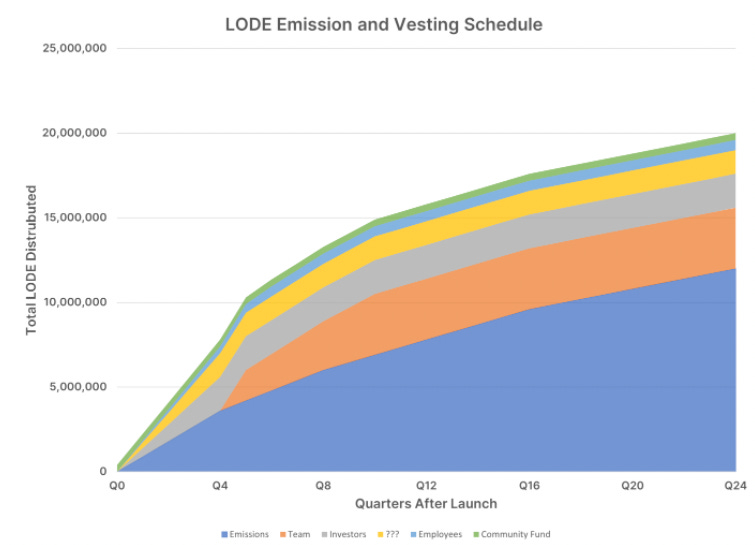

$LODE Total supply: 20M

60% to emissions

18% to team

10% to investors

7% to ???

3% to employees

2% to community fund

Emissions/Unlock schedule:

Important notes:

Team token are vested 1-year, unlocking then during 18months but 50% linear unlock in the first three months could create a supply shock

Emissions are 10k $LODE/day for the first year, then decreasing over the next 5 years which could heavily dilute holders the first year

Investors of the fundraise are linearly vested for the first year

About emission, let's put rough math: $LODE at $0.5 put Mcap at $10M

That’s $5K/day for emission towards LP and/or market vaults (lend/borrow) to attract liquidity, stimulating borrow/lend.

Could Lodestar offset that emission with revenue generated by the protocol? That's for another thread Anon.

Value Accrual/Value Proposition:

$LODE is a Governance token and a protocol revenue sharing.

By staking $LODE, stakers earn a proportional share of protocol revenue through fees redirected to them (that's your #realyield):

10% Performance fee on emissions/yield of deposited liquid staking assets (plvGLP, plsDPX, GMX…)

50% fee on token allocated to the reserve

When borrowers pay interest, nearly all of it is paid to lenders but a small part is directed to the Reserves of the borrowed token. 50% of this small allocation is directed to $LODE stakers

It acts as an insurance fund to always have more money in the protocol than the total amount deposited. Here is the reserve factor ratios:

TBC by the team: possibility to claim rewards in individual yield currencies (PLS, ETH, drMAGIC) or in single asset like ETH.

Nice feature: Lodestar automatically stakes your $LODE emission for you so you can start earning yield!

TAM on Arbitrum

So what's the TAM here? Lending TVL in DeFi is $14B all chains included.

Today Lending TVL for the Top5 protocol on Arbitrum is around $70M:

GLP market cap is : $383.7M (51% are stables, USDC, USDT, DAI)

Plutus vault accounts for $5.187M deposited at time of writing

Vesta vault accounts for $6.740M deposited at time of writing

GMX market is around $300M.

Stables on Arbitrum roughly account for $1.2B, steadily growing and a good chunk deployed in some major dApp/bridges/pools on Arbitrum:

There is an untapped market for GLP and GMX for sure. For USDC, BTC and ETH, LTV is approximately the same as the competition but borrow rates are more attractive given the higher utilization rate. This could attract liquidity, especially with $LODE incentives. This blue chips liquidity may be less sustainable than GLP and future liquid staking assets as the competition could be rough and more subject to mercenary capital farming $LODE.

Competition:

Numbers from CoinGecko/DeFiLama:

Previous table indicates that Lodestar should play easily in the $20M-40M TVL range in a short timeframe imo.

As said earlier, liquidation threshold are similar between money markets in Arbitrum:

Roadmap:

V0:

Compound fork with minimal modifications to support Arbitrum assets.

Supported assets at launch: ETH, USDC, MAGIC, DPX, USDT, BTC, FRAX, MIM and plvGLP.

Release expected in November after a new round of fundraising. Team is waiting for Aelin to be deployed on Arbitrum allowing more wallets to be whitelisted compared to Ethereum.

V1:

Lodestar will release their own Vaults for some assets like GLP, likely something similar to Plutus architecture and allow the collateralisation of liquid staking assets like plsDPX and drMAGIC.

Lodestar will stake these liquid assets so you can earn the underlying asset yield and use them as collateral.

The dynamic emissions feature is also interesting as a portion of emission would be directed to specific assets to incentivise and stimulate liquidity toward the protocol.

The stacking contract should also be released in that version enabling the $LODE #realyield (TBC).

Strategies

Lodestar team wrote an interesting article giving strats for plvGLP backed by nice examples:

Utilizing plvGLP in Lodestar Finance

Short summary:

Leveraged long with looping → Borrow USDC, buy plvGLP (buy GLP, deposit into Plutus vault), lend these plvGLP, rinse and repeat

Be careful degen when using leverage. Also remember that there is an exit fee of 2% on the plvGLP vault when exiting a position.

Deleveraging a position could burn your earned yield. Plutus mentioned they could offset this exit fee for protocol building on top of plvGLP, but that doesn't apply here as you will loop yourself.

Leveraged short with looping → Same as leveraged long but borrow ETH instead of USDC, buy plvGLP rinse and repeat

Hedging → Borrow ETH, buy plvGLP, no loop

Be careful, if looping is popular (and it should be degens), borrowing interest on USDC/ETH could explode and destroy your yield.

Self repaying loan → plvGLP will accrue value in time + interest APR

As long as this cumulated APR exceeds borrow APR, you’re basically paid to borrow

I’m dreaming of an automated strategy for this self-repaying loan. Lodestar could sell your lending asset yield on your behalf to repay your loans. Maybe in V2?

Security

Risks:

Smart Contract risk

Dependency risk of Plutus pls and plv vaults

Market Volatility and Oracle exploit

Lodestar is relying on Chainlink price feed except for plvGLP on the V0 release

Audit:

No audit on V0 as it’s a Compound fork and codebase was audited and battle tested. Audit is planned for V1 as there will be new features added. Funds raised during the community round will be used for this audit.

Conclusion

Imo, Lodestar seems a promising project, clear roadmap, good market fit and community oriented team. My only concerns are the $LODE emissions and anon team.

Let’s see how the launch goes and what TVL will be catched.